Liberation Day Commentary & Strategies to Survive a Market Downturn

Concerned about where stock markets are headed? When it comes to investing your money, your main goal is no doubt to grow and preserve your wealth. Investing in equities has historically provided a good long-term rate of return. But it’s easy to forget that when market volatility arises.

When the stock markets fluctuate, your immediate reaction may be to sell your investments and sit on the sidelines. However, lessons from past market crashes and financial events can help you weather potential market downturns. One lesson is that it’s best to diversify your investment portfolio and stay invested.

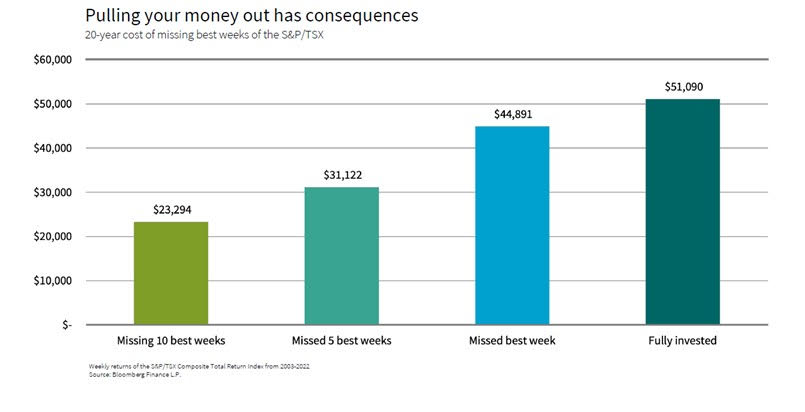

You can’t afford to miss the best weeks. Over the past 20 years, those who stayed invested came out further ahead.

Key takeaways :

- Diversification (spreading investments across asset classes) can help you weather a market downturn and reduce risk.

- Staying invested enables you to benefit when markets bounce back.

- It’s important to avoid making investment decisions based on emotion, and there are several strategies you can use to prevent emotions from guiding your investments.

- Significant market fluctuations may make you question your investment plan, but it’s important not to panic.

- Historical data shows that a declining market always eventually recovers and becomes even more dynamic than before.

- You can use the Dollar Cost Averaging method. You invest the same amount of money on a regular basis, regardless of the price of the investment.